On our last blog we talked about our 2020 goal: operate in DO-mode. This isn’t a foreign concept to our practice or a new player in our bag of tricks. But what is new, is our emphasis and our focus.

We also talked about Gary Vaynerchuk (@garyvee – follow him now) and his philosophy of speed being it. This week we’re talking about how we’re accomplishing speed and more advanced data and information collection using a dynamic approach.

The idea of dynamic research was inspired by a practice originally introduced in the tech world to make systems and software more agile. It’s called Scrum. Weird word, cool concept. Scrum is defined as an empirical framework for learning. Sounds complex, but when you break it down it means a way of learning that is practical, experimental, experiential, realistic. Getting to the essential (read: important, not basic) information you need to make decisions. Isn’t that what we all need to do? We vote yes. More importantly, in the practice of Scrum, decisions are made by a collaborative team and based on an “inspect and adapt” process to address complexities, risks, and opportunities as they arise in real-time. Scrum emphasizes decision-making from real-world results rather than speculation, in a continuous vs. staged process.

Practical. Realistic. Collaborative. Risk-tracking. Opportunity-tackling. Real-time. Real-world results. Sounds good, right? That’s how we define dynamic research and our obsession with uncovering the 20% that provides 80% of the data and insight to make a decision, as quickly as possible. Yes, technology and new data inputs have an important role, but it really requires a new way of thinking and DO-ing things in our practice.

WE NEED TO CHANGE HOW WE DO

So, what does this mean in practice? Traditionally market research and consumer intelligence have been a process of well-planned, documented steps, methods, analyses, and output. A solid approach when the pace of business is steady, actions (somewhat) predictable, and information universally collected and understood. However, today’s market is different. Business moves faster than we can think, actions are erratic, and information is available everywhere and interpreted in every way depending on the audience. We need to adjust. Not to keep up, but to re learn how to DO from the new environment around us.

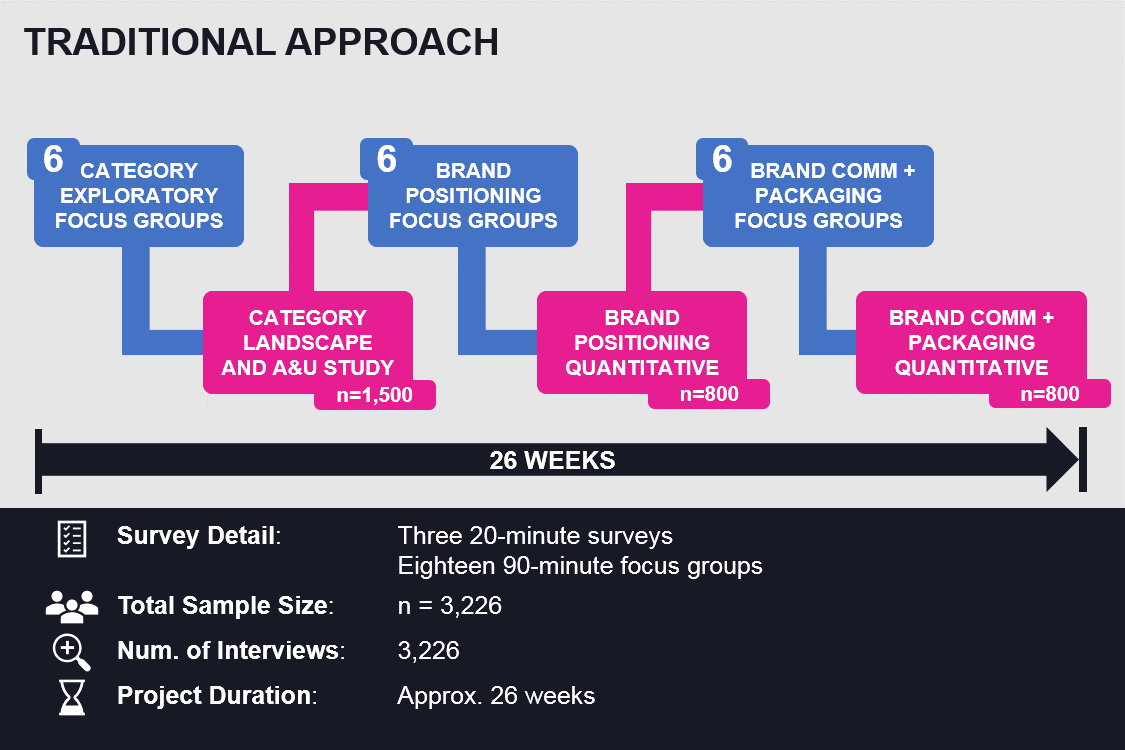

Even though clients’ business journeys are diverse, and their use of information is different, much of the information they are seeking is similar – Who is our target? Why do people care about our brand? What should we say to outshine the competition? How can we grow? What about new markets? A few examples of outcomes we talk about with our clients each and every day. Traditionally those questions are explored and solved with a segmentation study, positioning testing, brand tracking study, market analysis, etc. And we are really good at those methods. And will continue to be for those who are attached (learn to let go now). In the past few years, we have been working towards a solution that might be right for clients looking for a different research scenario (i.e. a breadth of knowledge vs. depth of knowledge). One that is dynamic in every sense of the word.

THE E2A DYNAMIC SOLUTION

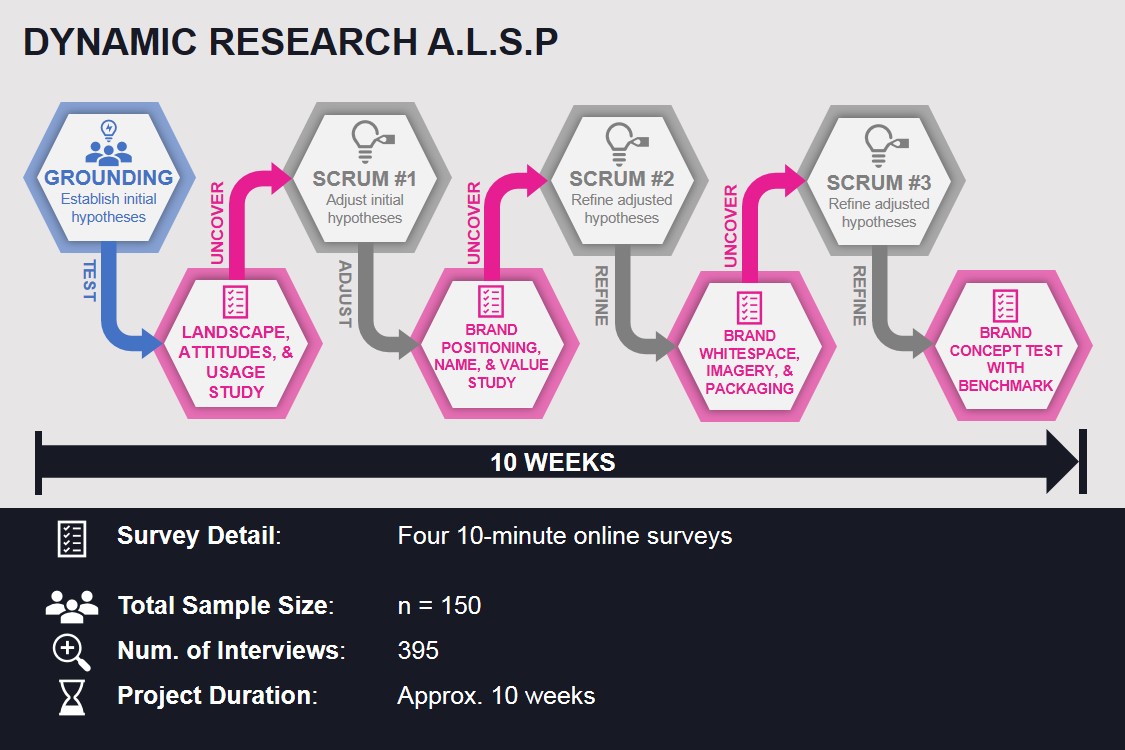

We have developed a research process that gathers the critical information needed to analyze and make decisions more wisely and more efficiently. E2A’s agile longitudinal survey program (ALSP) is an example of a Scrum approach that incorporates several phases of research into one process, thinking and output.

The ALSP process is different than traditional research for a couple of reasons (and time to complete is not the only thing). One, unlike traditional market research methods where a new sample is incorporated at every phase, ALSP respondent base is consistent from start to finish. The same folks we talk to during survey one, are still with us at the end of survey 4 (at least some of them). Often times the ones that are still there at the end are the ones we care most about. Two, instead of using exploratory research to define initial ideas and inputs, we use working hypotheses to fuel the content of survey one, and input & adapt from there.

The ALSP research approach allowed us to reach our project goals in half the time. But more importantly, the rich insights that we uncovered throughout the journey came from the respondents that were the most interested and engaged in the category and product. Oh, and by the way, we were able to do it within the client’s tighter budget, too.

This is why in 2020 we decided to shift our focus from where we want to go, to how we’re going to get there. DO mode is our true north for 2020.

If you’re interested in learning more about our dynamic research approach or ALSP methodologies, please feel free to reach out to anyone here at E2A PARTNERS.

Written by E2A PARTNERS